With the growing adoption of bitcoin, regulated financial markets are eager to capitalize on this newly popular asset class. One of the most popular financial instruments in the world is an “Exchange Traded Fund” (“ETF”). An ETF is pretty simply what the name implies: funds that trade on exchanges, generally tracking a specific index–in this case, the price of bitcoin. However, there are also two types of ETFs based on an asset price.

First, is a futures market ETF, which does not hold the underlying bitcoin itself. Instead, it uses financial derivatives, such as futures contracts priced on the Chicago Mercantile Exchange (“CME”), to replicate the performance of the underlying ETF. In practice, a futures market ETF might use Bitcoin futures contracts to mimic the price movements of Bitcoin without actually owning the cryptocurrency. Futures contracts allow investors to speculate on the price of an asset without directly owning it or having to take delivery of the asset when the futures contract expires. An ETF based on the futures contracts is governed generally by the Investment Company Act of 1940, which is focused primarily on the establishment of a regulatory framework for retail investment products.

The second type of ETF, is based upon the spot market price of bitcoin, whereby the ETF tracks the actual market price of the underlying bitcoin. Practically speaking, a spot market ETF would hold the actual bitcoin to back the issued shares of the ETF. This means that investors in the ETF indirectly own a portion of actual bitcoin available in the market. Further, the actual bitcoin would be held at a custodian to represent the outstanding shares of the ETF, fully collateralized at all times. Additionally, when people buy more shares of the spot market ETF, it triggers the creation of new shares in a spot market ETF which then results in the acquisition of more bitcoin at a 1:1 ratio to collateralize the ETF. As everyone who follows bitcoin knows this can impact the supply and demand dynamics of bitcoin substantially. A spot market based ETF would be governed generally by the Securities Act of 1933.

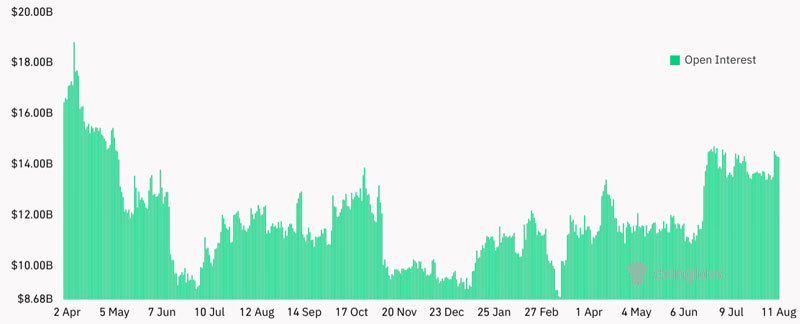

Currently available today, the Futures ETF, was approved in October 2021 and is traded under the symbols $BITO, $BITI, $XBTF, $BTF, $MAXI and $BITS. Currently, open interest in these ETFs is at ~$15 billion in daily notional volume, which is just slightly below all-time highs–even in this current bear market. The futures ETF is deemed less susceptible to market manipulation as the underlying contract trades on the regulated CME. Whereas, a spot market based ETF would be pegged to the price of bitcoin traded on spot market exchanges like Coinbase which are state regulated.

Also available currently, on June 25, 2023, a leverage futures ETF which “seeks investment results that correspond to two times (2x) the return of the CME Bitcoin Futures Daily Roll Index”, trading under the symbol $BITX was approved. This leveraged ETF came as a shock to many, as generally a spot market ETF would precede a leveraged instrument. Generally, leveraged ETFs are more volatile and less suited for retail investors, which is generally puzzling how it was approved by the Securities Exchange Commission (“SEC”), despite their public stance that their mandate and reluctance around bitcoin is rooted in a duty protect retail investors.

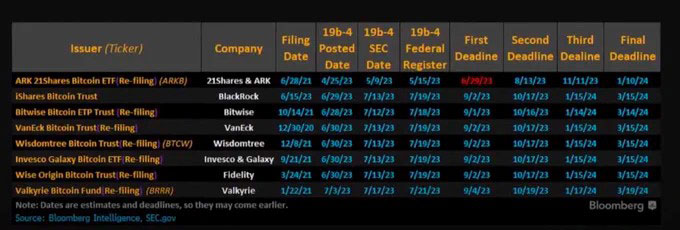

Conversely, for the spot market ETF, progress continues to be stalled as just last week the SEC, has called for public input on the Ark 21 Shares bitcoin spot ETF application, delaying a final decision by nearly eight weeks. The SEC put forward four reasons for not approving, including: whether the Bitcoin spot ETF will be easily manipulated; whether CME market controls are enough; whether the custodian agreement with Coinbase will help prevent manipulation. Below is a timeline of the 8 current spot market ETFs and their calendar.

When digging into each application, we see that all the final deadlines seem to coincide in roughly mid-March. As the SEC did with the Futures ETF, they blank approval all in the same action, therefore not to give any applicant a head start. It is permissible to assume that this pattern will continue with the spot market ETF. That being said, the safe assumption for approval could be March 2023. Such an event would be an enormous tailwind for the price of bitcoin. Often called digital gold, if bitcoin spot ETF was analogous to when the spot market ETF for gold was approved in 2004, the price of gold saw a rapid rise over 340%. If the same occurred with bitcoin, we would see a spot market price of $138,000. Tom Lee of Fundstrat Global Advisors, appearing on CNBC, said approval of a spot bitcoin ETF could see the price jump more than five-fold from current levels. “I think the demand will be greater than the daily supply of bitcoin, so the clearing price […] is over $150,000, could even be $180,000,” Lee said.

If the spot ETF is approved in March 2024, that could put billions of everyday buying pressure on bitcoin, leading to further price increase. Additionally, as we know the next bitcoin halving is happening in roughly April 2024, which historically has been very bullish for the price of bitcoin as the daily supply is cut in half instantly. These two major macro forces of increased everyday buy pressure, plus immediate 50% daily supply cut, both happening in rapid succession, could likely kick off the most dramatic bull market this asset class has ever experienced. Plan accordingly.

Article by: Steve at https://vtrader.io/

0 Comments