What is needed to formalize inheritance abroad? Legal support in inheritance matters. Reasons for renouncing inheritance and the consequences for heirs.

Inheritance abroad can be a complex and significant issue for families with property or close relatives in different countries worldwide. The inheritance process can involve various legal systems, cultural nuances, and administrative procedures, requiring careful study and professional guidance. To receive an inheritance abroad without unnecessary complications, it is best to use the services of an international probate lawyer.

Inheritance abroad: Key aspects

The inheritance of property abroad is regulated by the laws of each specific country. This can include general principles of international private law as well as specific domestic rules regarding inheritance rights. For example, in the European Union, there are general rules for the recognition and enforcement of inheritance decisions in all member states, but each country has its own peculiarities.

Inherited property can include movable assets (money, securities, valuable items) and immovable assets (real estate, land plots). Each type of property has its own characteristics regarding inheritance, the determination of inheritance rights, and taxation.

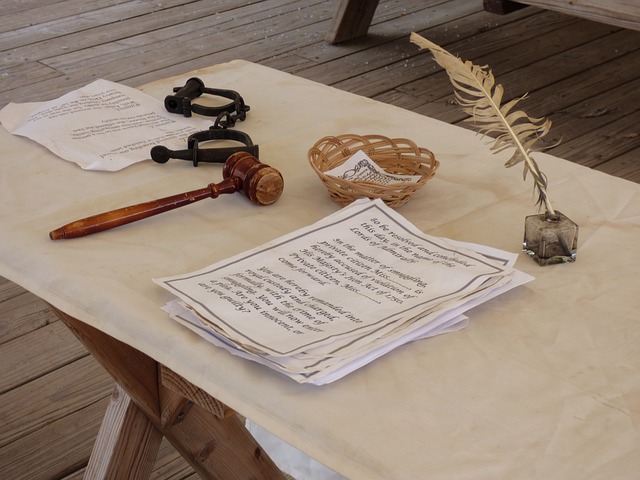

For the inheritance of movable assets, documents of intent, such as a will or testament, are often required. Immovable property may need to be registered with the appropriate government authorities in the country where the property is located. The inheritance process can involve the notarization of documents and other formalities.

Heirs often face tax obligations both in the country of the inheritance law and in their country of residence. The tax consequences of inheritance can vary depending on the type of property, its location, and the applicable legislation. For example, some countries may have special rules regarding discounts or exemptions on inheritance tax for close relatives.

Reasons for renouncing inheritance

Renouncing inheritance by will is an important aspect of inheritance law that can have significant legal consequences for heirs. Sometimes heirs may decide to refuse assets for various reasons, such as substantial debts of the deceased, unwillingness to accept certain obligations, or personal circumstances.

One of the main reasons for renouncing inheritance is the presence of large debts of the deceased that exceed the value of the inherited property. Another reason could be conflicts among heirs or personal circumstances that make accepting the inheritance undesirable.

The procedure for renouncing inheritance depends on the legislation of the specific country. Typically, the heir must submit an official statement of renunciation to the relevant government authority or court within a specified period after the death of the deceased. The renunciation can be made either in favor of other heirs or without specifying particular individuals. An heir who renounces the inheritance loses all rights to the inherited property, including any potential benefits. Additionally, their share of the inheritance may be transferred to other heirs according to the inheritance agreement or legislation.

0 Comments